Understand your customers with data

Services & products that bring the power of customer data to your organisation.

Services & products that bring the power of customer data to your organisation.

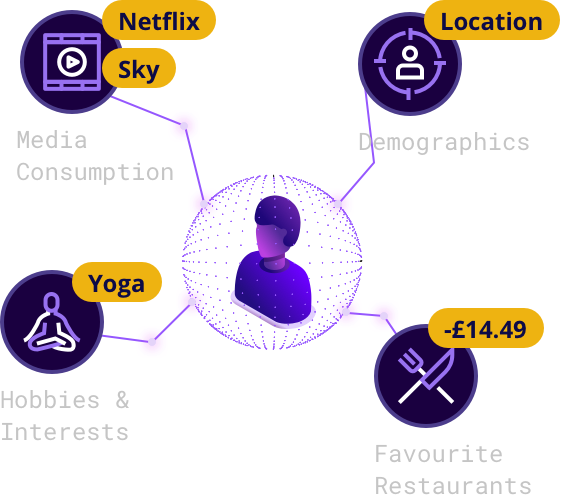

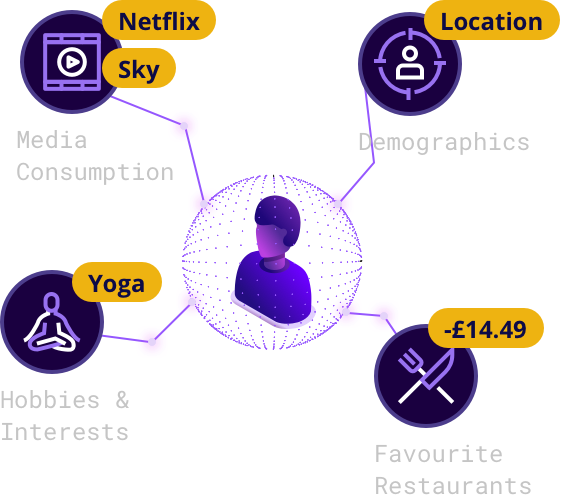

Understand consumer needs, preferences and analyse how they evolve over time with access to 24 months of historic and ongoing customer insights based on income and spending data.

![]()

Understand what products and brands different segments of consumers will need, when they will need them and the price they will pay

![]()

Take the guesswork out of your market research through a 56% increase in the accuracy of your customer data versus survey activity

![]()

60% data consent rates versus 2% account cancellation rates mean you can stay connected to your consumers as their needs evolve

Check the affordability and credit-worthiness of potential customers and data-subjects in an instant.

![]()

Understand their income, regular expenses and disposable income and uncover trends using up to 24 months of historic data

![]()

Understand the consistency of their payments, bounced payments and repeated policy cancellations

![]()

Understand what their overall financial situation is including the presence of long term debt, short term loans and overdrafts

Reduce fraud by verifying customer information against the personal information that has already been validated by their bank, within a few seconds

![]()

Verify that the data-subject has given you the correct name and address information as verified by their bank

![]()

Verify that the data-subject’s bank account and sort-code are correct to prevent any mistakes or intentional misinformation

![]()

Verify that the data-subject’s date of birth and age are correct to prevent any mistakes or intentional misinformation